The best advice Ben Bernanke learned during his 12 years working in Washington D.C. was that if you want a friend there, you should get a dog.

Bernanke has two.

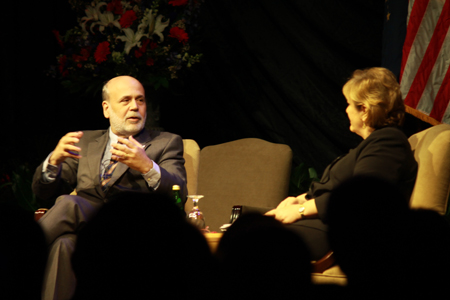

Bernanke, who served under President’s George W. Bush and Barack Obama, is the former chairman of the Federal Reserve System. He discussed his role in aiding the country’s revival from economic downfall at 6 p.m. Monday in the Physical Activities Center.

Bernanke finished writing a book about his Washington D.C. experiences last week, and USI is the first university he has spoken to on his tour.

“A Conversation with Ben Bernanke” was the second event of the Romain College of Business’ innovative speaker series and drew more than 2,500 people.

The visit was moderated by Professor of Communications Karen Bonnell, during which she asked questions submitted by students and quoted the 2009 Time Magazine article that named Bernanke Person of the Year.

Bernanke responded to the Time quotes saying that Hitler, Stalin and the Internet have also earned the title.

His talk began with a short summary of the country’s rise from economic downfall following the “Lehman Weekend,” during which the Lehman Brothers Holdings, Inc. – an investment banking company – infamously filed for bankruptcy.

During the fall of 2008, the media as well as the rest of the country felt it was time to “let a company fail,” he said, but Bernanke and the Federal Reserve thought that was a bad idea during a financial crisis because the country was “on the brink of collapse.”

He said that now, the U.S. has recovered from the crisis better than any other country.

During the Q&A portion, Bonnell talked about Bernanke’s upbringing in Dillon, South Carolina and asked why the speaker didn’t have an accent.

“I can talk that way if I want to,” he responded in a southern drawl.

Growing up in the south, Bernanke was sharper than average, placing 26th in the National Spelling Bee at age twelve and teaching himself calculus.

He said as a young adult his first step was to get out of his small hometown.

That step led him to Harvard.

He knew that he enjoyed math, social sciences and history, he said, but eventually settled on macroeconomics as a junior, which combined aspects of all three.

His thesis adviser, Stanley Fischer, gave him a large book by Milton Freidman, and said, “Read this, and if you don’t fall asleep, you should take monetary economics.”

Bernanke did and was intrigued, which eventually propelled him into his future career in politics, which was “by accident.” Fischer is now the Vice Chairman of the Federal Reserve.

Shortly after 9/11, while Bernanke was Chair of the Economics Department at Princeton University, the Bush adviser approached him to interview as chairman of the Federal Open Market Committee, which is in charge of policymaking for the U.S. monetary system.

Three years later, he was appointed chairman of the Federal Reserve System.

As chairman, Bernanke made creative, unique and innovative use of existing policy instruments.

Bernanke said he would gather his staff in one room and hold “blue sky thinking” sessions to brainstorm new ideas and possibilities.

“It was a great way to get ideas,” he said. “When people feel involved more in the process, they become more committed.”

He also brought transparency to the Reserve.

He said all central banks should be democratically accountable and open, and also instituted the policy that his position would hold press conferences.

“Probably the toughest part was the testimonies before congress,” he said, saying that he did so 78 times in his run as chairmen.

He said he tried to maintain Zen and was known as the “Buddha of central banking.”

Bernanke said he also brought an academic approach to the Reserve.

“After a very slow recovery, we are moving in the right direction,” he said of the country’s current state, adding that the global economy is still weak with the U.S. being the “star performer.”

“Those of you who are seniors are in much better shape,” he said, saying that three million jobs were created in the U.S. in 2014.

Bernanke said two things impact economic growth: the size of the labor force and changes in technological products.

Bonnell read a student question that asked about the “income inequality problem.”

“I think America in general doesn’t care if there are people with a lot more money,” Bernanke said, referencing the masses flocking to see Fred Astaire. “What is important is what is happening to people in the middle.”

Despite economic growth, the middle class is being “hollowed out” in regard to income, he said.

“People need to have the training and skills to deal with technology,” Bernanke said, saying a lack of skill-sets is the cause of this issue.

Bonnell also read a question regarding the “student loan bubble,” to which Bernanke said student loans weren’t always available.

“Not long ago was it that if you didn’t have enough money, even if you had good grades, you didn’t go to college,” he said, saying that there is probably not enough loan counseling happening. “People have to be smart about how much money they take out.”

Bernanke gave financial advice for young people: stay in school and find what you are interested in, save if you can and have a good adviser.

“The biggest investment you’re going to make is in yourself,” he said.

He donated $40,000 to the USI Foundation for student scholarships.

Ryan Elpers, a junior engineering major said he agrees with Bernanke’s stance on student loans.

“You have to have a job whenever you want to graduate to be able to repay those student loans,” Elpers said. “If you graduate and then you don’t have a job to go to you are going to be stuck owing a lot of money you don’t have.”

USI French alumna Connie Pilcher attended the event for a post-graduation business class she is taking.

She said she was surprised how personable Bernanke was because she expected a “to the T businessman.”

“I like the way he brought the academic view to deal with the crisis,” Pilcher said. “He was not just some Wall Street guy.”

Bernanke said regardless of all that he has accomplished, his biggest accomplishment is having two children in medical school who are hard workers, and a wife who keeps him grounded.

Now that he is retired, he said he wants to continue to write, speak and teach.

“I am still trying to figure out what I want to do when I grow up.”

Sarah Loesch contributed to this story.