What’s the cost?

When people think of attending college often they think of student loans, debt and financial need.

According to debt.org student debt in the United States adds up to $1.2 trillion and since 1980, tuition costs have gone up 757 percent. Seventy percent of college students leave university with an average debt of $33,000.

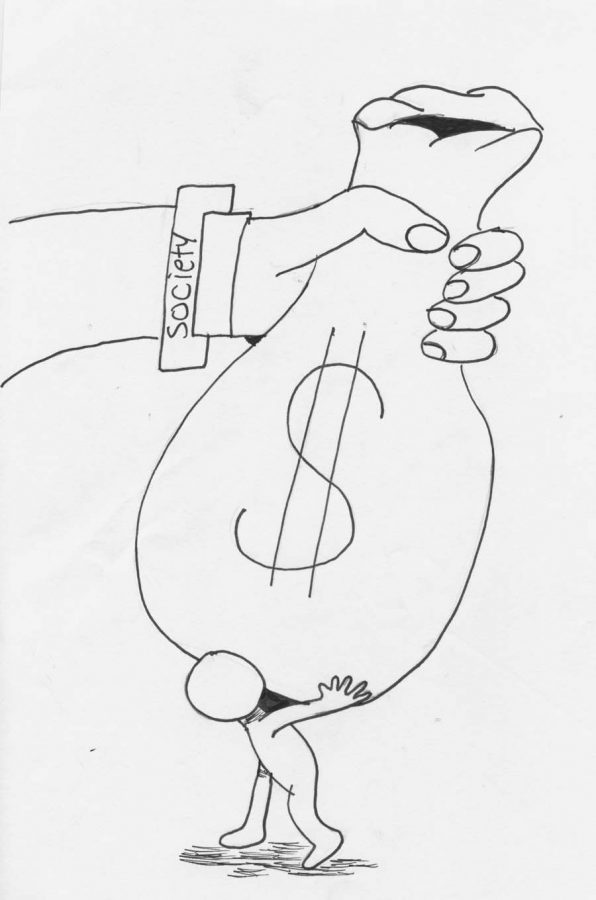

Many students have the burden of finances hanging over their heads as soon as they step through the door of their first class. Students have to worry about how they will afford their next meal when they should be worrying about homework.

We are forced to work extensive hours at our jobs to try and afford college to avoid loans or to prepare to pay them off after graduation.

Instead of trying to major in something they love students have the constant fear of not having a well-paying job after college ends to support them.

Although FAFSA is helpful for some, it can barely help those who “can afford two toppings on their Papa John’s pizza.”

As society drops a bag of money onto our back we have to carry our burden around for years after we graduate.

There are currently 43.3 million Americans facing student debt and face an average monthly payment of $351 a month.

Not to mention other bills, families and necessities that contributes to massive amounts of debt.

Not only does it have an affect on what we spend our money on, finances play a role with mental health.

According to the Atlantic.com “It’s been well documented that financial strain can have measurable mental and physical effects. A 2013 study published in Anxiety, Coping and Stress, for instance, found that ‘those with greater financial strain perceived more stress, had more symptoms of depression, anxiety, and ill-health.’ And significant or growing debt, can be a major cause of overall financial stress.”

Financial burden is hard to face.

It’s not right that we spend our school careers stressed about where are next penny will come from.

Don’t let debt cost you your health and sanity.